Where to Order Cryptocurrencies: Ideal Platforms for Rapid and Secure Deals

Where to Order Cryptocurrencies: Ideal Platforms for Rapid and Secure Deals

Blog Article

Recognizing the Basics of Cryptocurrencies for Beginners

The landscape of cryptocurrencies provides a facility yet interesting chance for novices to the financial world. Recognizing what cryptocurrencies are, just how blockchain technology underpins their procedure, and the various types offered is important for informed engagement. Realizing the value of digital budgets and identifying the connected threats and benefits can dramatically influence one's strategy to spending in this quickly advancing room. As we check out these fundamental components, one must take into consideration: what are the vital factors that can affect both the stability and volatility of this market?

What Are Cryptocurrencies?

Although the idea of currency has developed considerably over time, cryptocurrencies represent an advanced shift in just how worth is exchanged and saved (order cryptocurrencies). Defined as electronic or online money that utilize cryptography for safety and security, cryptocurrencies operate separately of a central authority, such as a government or financial institution. This decentralization is a crucial characteristic that distinguishes them from standard fiat currencies

Cryptocurrencies feature on a modern technology called blockchain, which makes certain openness and security by tape-recording all deals on a distributed ledger. This advancement permits peer-to-peer purchases without the requirement for intermediaries, decreasing purchase expenses and boosting efficiency. Bitcoin, released in 2009, was the first copyright and remains the most identified; nevertheless, hundreds of options, referred to as altcoins, have since arised, each with distinct functions and use cases.

The charm of cryptocurrencies depends on their potential for high returns, privacy, and the capacity to bypass traditional financial systems. They come with integral risks, consisting of cost volatility and regulative unpredictabilities. As cryptocurrencies remain to get traction, recognizing their basic nature is essential for any person seeking to involve with this transformative financial landscape.

Just How Blockchain Modern Technology Functions

The decentralized nature of blockchain implies that no solitary entity has control over the whole journal. Rather, every individual in the network holds a copy, which is constantly updated as new transactions take place. This redundancy not only enhances safety however also advertises openness, as all customers can verify the purchase history.

To validate deals, blockchain uses an agreement system, such as Evidence of Job or Proof of Stake, which needs individuals to solve intricate mathematical troubles or prove their risk in the network. This process discourages malicious activities and maintains the honesty of the journal. On the whole, blockchain technology represents a revolutionary approach to data administration, fostering trust fund and efficiency in digital deals without the requirement for intermediaries.

Sorts Of Cryptocurrencies

Various kinds of cryptocurrencies exist in the electronic monetary landscape, each serving distinctive objectives and capabilities. The most widely known group is Bitcoin, developed as a decentralized digital currency to assist in peer-to-peer purchases. Its success has actually paved the way for hundreds of different cryptocurrencies, frequently described as altcoins.

Altcoins can be classified into numerous teams (order cryptocurrencies). Initially, there are stablecoins, such as Tether (USDT) and USD Coin (USDC), which are secured to typical currencies to decrease volatility. These are optimal for users looking for stability in their digital deals

Another category is utility symbols, like Ethereum (ETH) and Chainlink (WEB LINK), which grant holders particular legal rights or accessibility to solutions within a blockchain ecological community. These tokens usually fuel decentralized applications (copyright) and clever contracts.

Comprehending my site these sorts of cryptocurrencies is crucial for newbies intending to navigate the facility electronic money market successfully. Each kind supplies one-of-a-kind functions that provide to different individual requirements and investment methods.

Setting Up a Digital Pocketbook

Establishing a digital budget is an essential step for anyone aiming to take part in the copyright market. An electronic pocketbook acts as a safe environment for keeping, sending out, and getting cryptocurrencies. There are a number of sorts of pocketbooks available, consisting her latest blog of software application pocketbooks, hardware pocketbooks, and paper purses, each with distinctive features and degrees of safety.

To start, choose a wallet type that lines up with your demands. Software purses, which can be desktop computer or mobile applications, offer ease and convenience of usage, making them ideal for frequent transactions. Equipment pocketbooks, on the various other hand, offer boosted protection by storing your personal keys offline, making them optimal for lasting capitalists. Paper budgets include printing your personal keys and QR codes, using a totally offline option, but require mindful taking care of to stay clear of loss or damages.

When you pick a pocketbook, download or purchase it from a reputable source and comply with the setup directions. This typically entails producing a secure password and backing up your recovery expression, which is critical for recuperating access to your funds. By taking these actions, you will lay a strong foundation for your copyright tasks.

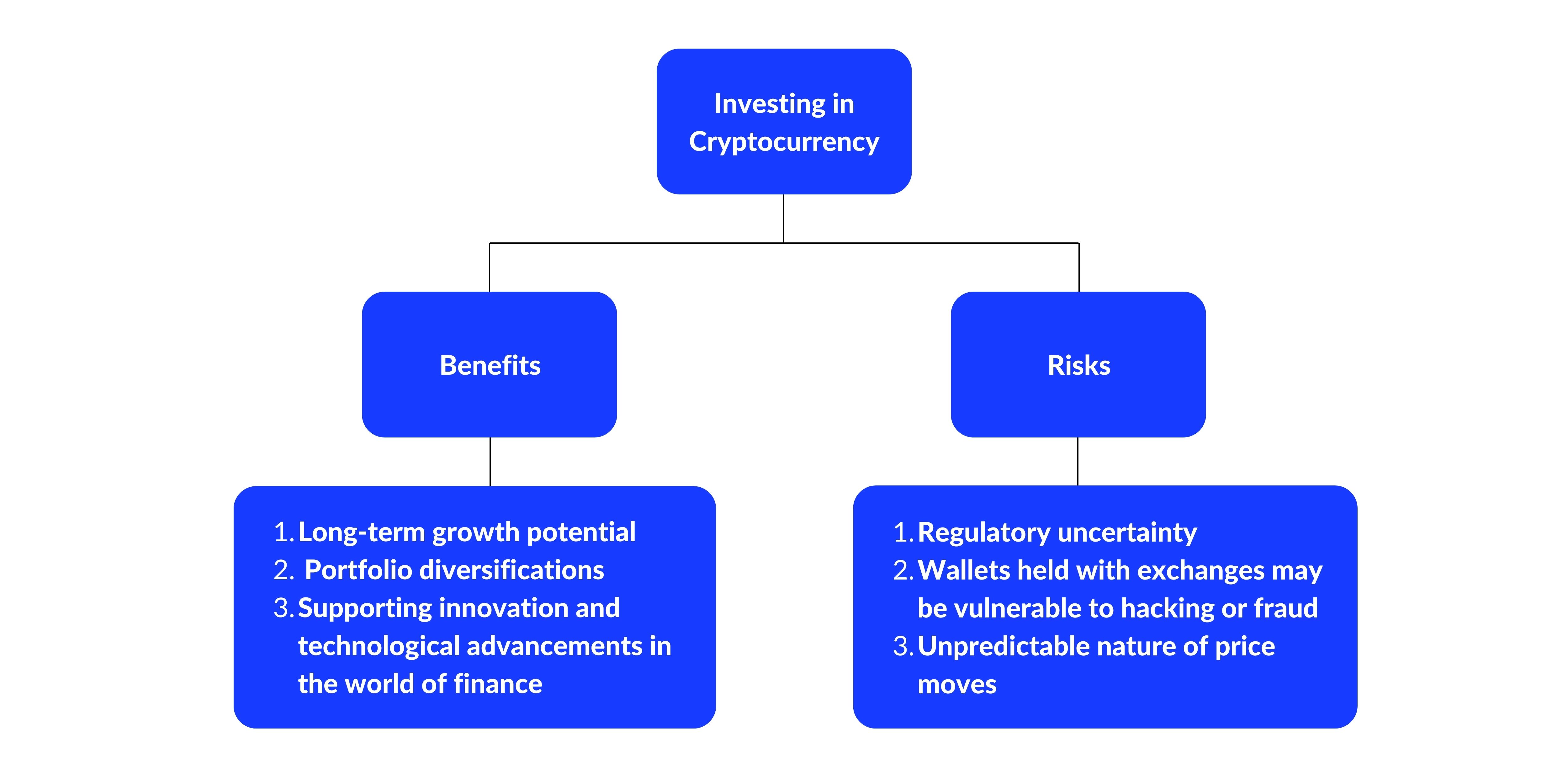

Threats and Benefits of Investing

Market volatility is a critical problem; copyright rates can fluctuate drastically within brief periods, leading to possible losses. Safety is an additional concern, as electronic wallets and exchanges are vulnerable to hacking, resulting in the loss of properties.

Financiers need to likewise be conscious of the technical intricacies and the quickly evolving landscape of cryptocurrencies. In recap, while spending in cryptocurrencies provides luring chances, it is vital to consider these versus the this website fundamental threats to make educated decisions.

Verdict

In conclusion, a fundamental understanding of cryptocurrencies is important for browsing the digital monetary landscape. Expertise of blockchain technology, the various types of cryptocurrencies, and the procedure of establishing an electronic purse is essential for safety. In addition, recognition of the fundamental threats and benefits associated with buying this unpredictable market is needed for notified decision-making. Embracing this knowledge can empower people to involve with confidence with cryptocurrencies and harness their possibility in the evolving monetary ecosystem.

Report this page